Employer Identification Number (EIN)

What is an Employer Identification Number?

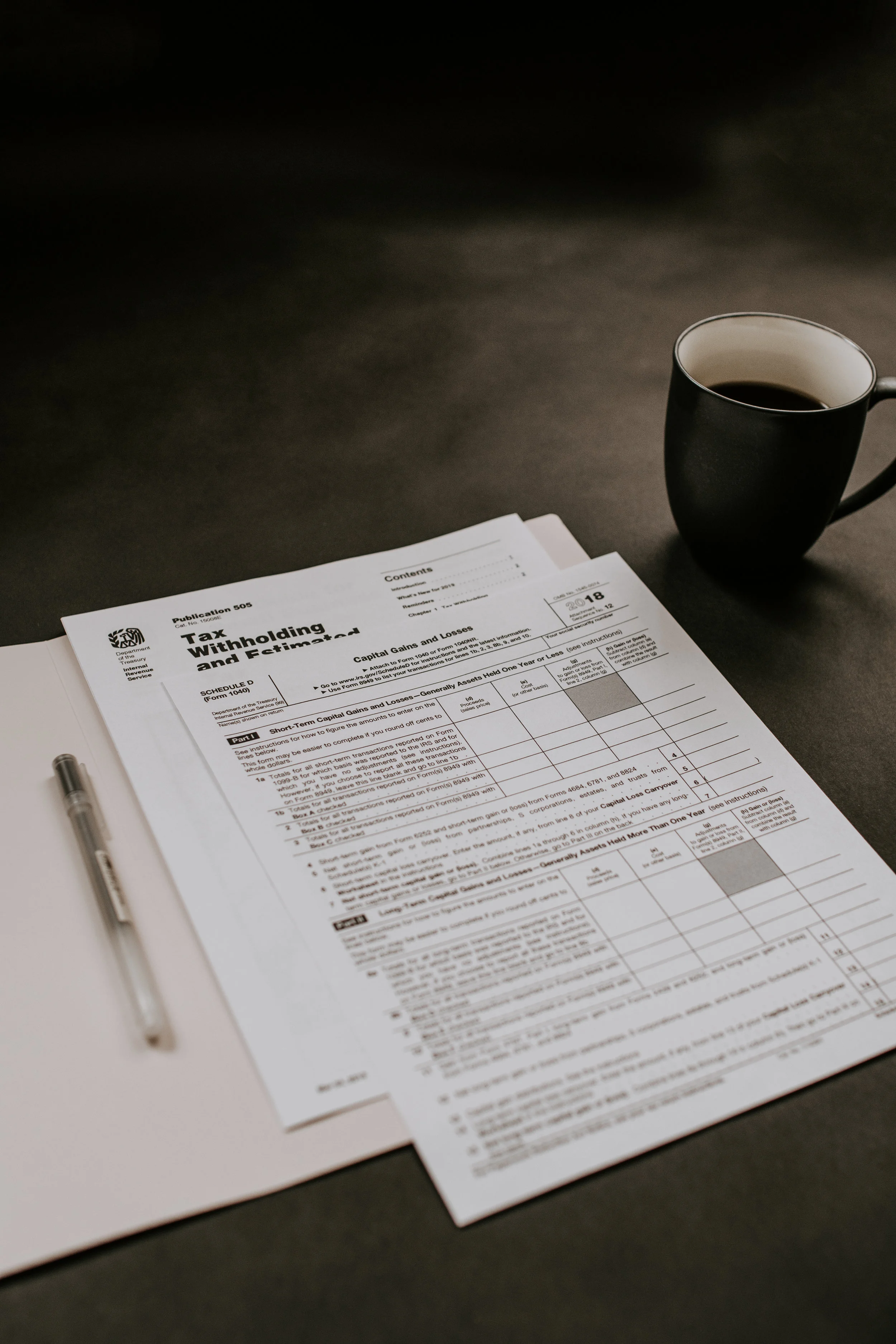

An Employer Identification Number (EIN), or Federal Tax Identification Number, and is used to identify a business entity. Generally, businesses need an EIN. This number appears on your tax forms and W2 forms. You will need it for almost everything - opening a business bank account, filing taxes, paying employees, being a legitimate corporation or partnership, applying for business licenses and permits, etc. It’s FREE to apply for an EIN online and you can get your EIN immediately. You will just need your name, social security number, address, and your fictitious or DBA name.

Do you need an EIN?

The last thing you want as a new business owner is to get in trouble with the IRS. Registering with the government and getting the proper identification is necessary to do basic things like selling or getting licenses. You will need an EIN if you answer "Yes" to any of the following questions.

Do you have employees?

Do you operate your business as a corporation or a partnership?

Do you file any of these tax returns: Employment, Excise, or Alcohol, Tobacco and Firearms?

Do you withhold taxes on income, other than wages, paid to a non-resident alien?

Other business identification numbers you should be aware of

State Tax Identification Number: Most states require businesses to pay additional state taxes, 43 states in fact. Getting a state tax ID is a similar, simple process as getting a federal tax ID, but guidelines vary by state.

Only 7 states have no income tax: Wyoming, Washington, Texas, South Dakota, Nevada, Florida, and Alaska. Tennessee and New Hampshire have income tax only on business dividends and business interest payments. Your state income tax will also vary by the type of business structures. In addition to income tax, your state tax ID also impacts business insurance for you as a business owner and for your employees.

Pro Tip

Read more about EID’s and prerequisites through the IRS.