Funding

What is the Paycheck Protection Program (PPP), and am I eligible? Should I apply? How much time is left? These are the questions thousands of entrepreneurs are asking…

With the government working to inject money into the economy as quickly as possible, it’s not surprising that there are unscrupulous individuals looking to take advantage. Here’s what to be on the lookout for.

The Small Business Administration (SBA) and Congress have put together special loans and grants to help small businesses and freelancers get through this difficult time.

While some entrepreneurs are blessed to have a team of investors lined up around the corner or an aunt with deep pockets, not having money is no excuse. By knowing your product or service, understanding the basics for your business, and knowing where you’re headed, you can bootstrap your way to a successful business.

Skysthelimit.org has broken business funding into three main types: typical (or traditional), lenders and investors. Read our article to learn more!

The typical ways entrepreneurs use to fund their businesses are personal savings and credit, partnerships, pre-sales and donations. Even if you do end up needing to raise more money to grow your business, getting as far as you can on your own is beneficial for many reasons.

Generally, a partnership is a business owned by two or more individuals. For it to be successful, you’ll need compatible values and vision, compatible financial resources and expectations, and compatible goals.

Personal savings are the money that a person keeps in an account in a bank or similar financial organization. Using your personal savings is the easiest and most cost-effective way to provide your own financing for a new business.

Loans are exactly that, money you borrow from someone else in the form of personal loans and and bank loans. Learn several small business loan options and the advantages and disadvantages for each!

In exchange for money from investors, you must give them a portion of ownership and control in your business. Typical investors are friends and family, angel investors, venture capitalists and crowdfunding.

Crowdfunding is a very new type of funding which takes advantage of the power of the Internet and allows the many people to pool lots of smaller sums of money for a business in which they believe.

Your friends and family may choose to invest in you through a gift, a loan or an equity investment in the business - whatever means, make sure you have a signed document or letter saying the money was given and what terms were agreed upon.

Angel investors are high-net-worth individuals who get an equity stake in return for their financing. They expect to make a profit and usually have business expertise they share with you to help your company grow.

Venture capitalists take equity in your business in exchange for big financing. These investors typically only do multi-million dollar deals and expect a big return on investment.

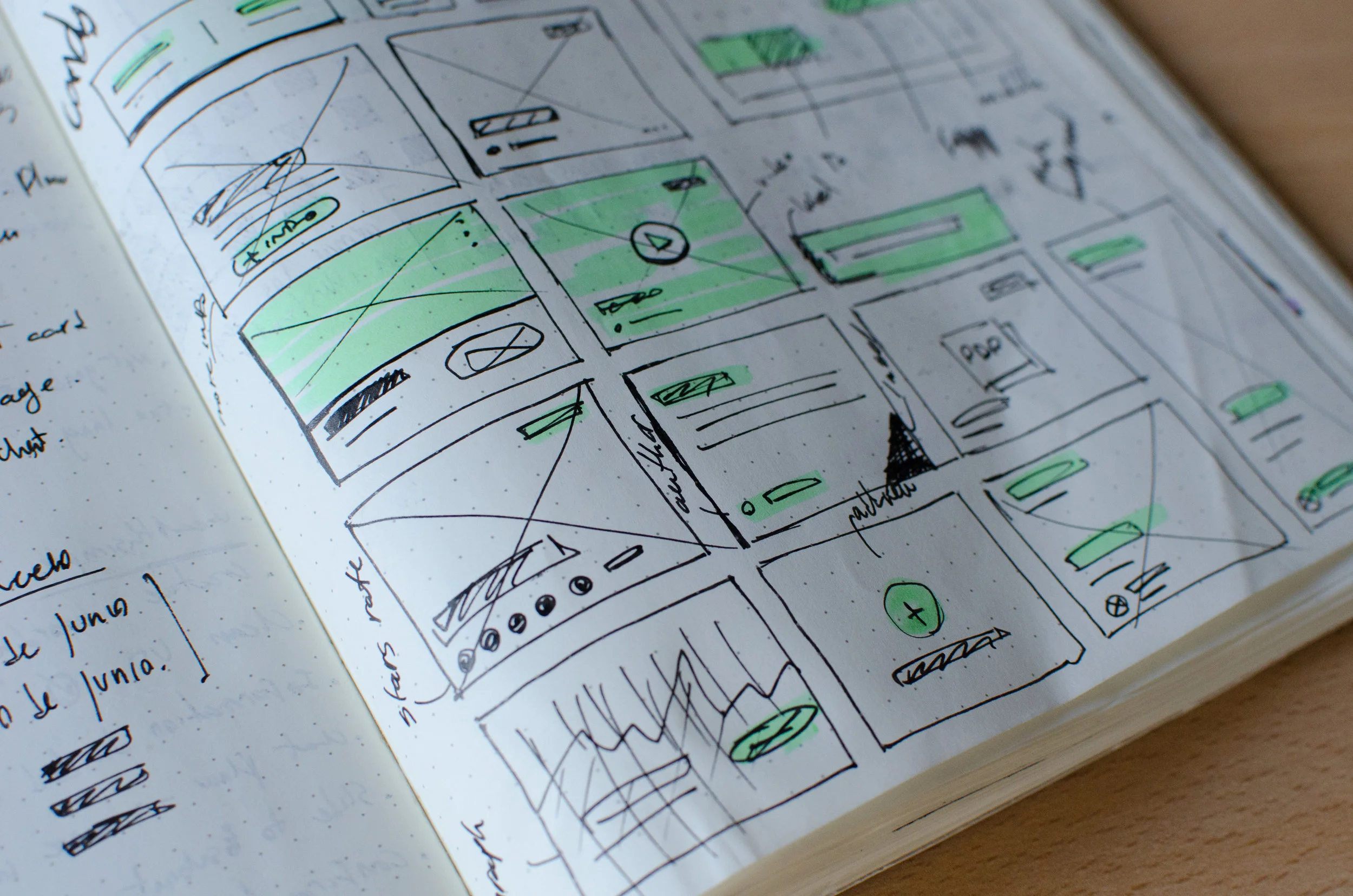

A pitch deck is a brief presentation used to provide your audience with a quick overview of your business plan. You will usually use your pitch deck during face-to-face or online meetings with potential investors, customers, partners, and co-founders.

Skysthelimit.org’s “Friends and Family Fund” provides startup grants up to $2,500 to selected young entrepreneurs in our community.